This is a question that many people ask: why does the stock market tend to grow in value in the long term? Take for example the S&P 500 Index. The S&P 500 is the combined value of the 500 largest corporations listed on the New York Stock Exchange.

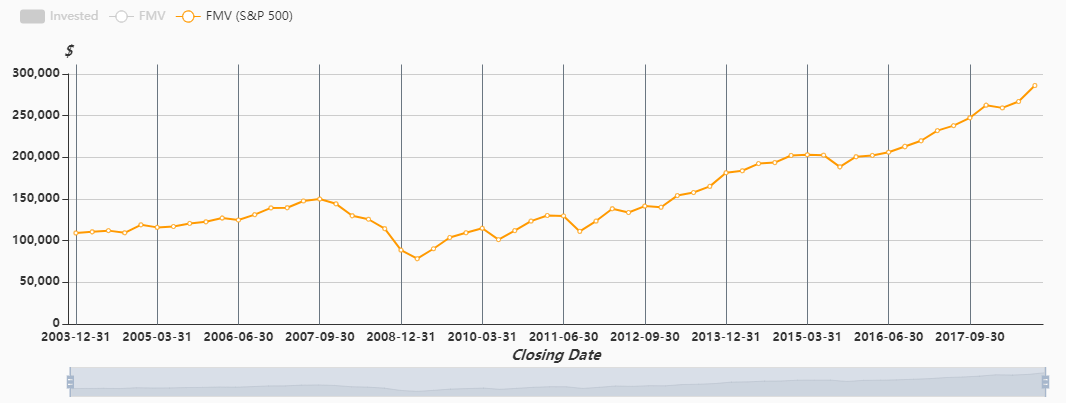

CRM2Plus: Fair Market Value of the S&P 500 over 15 years

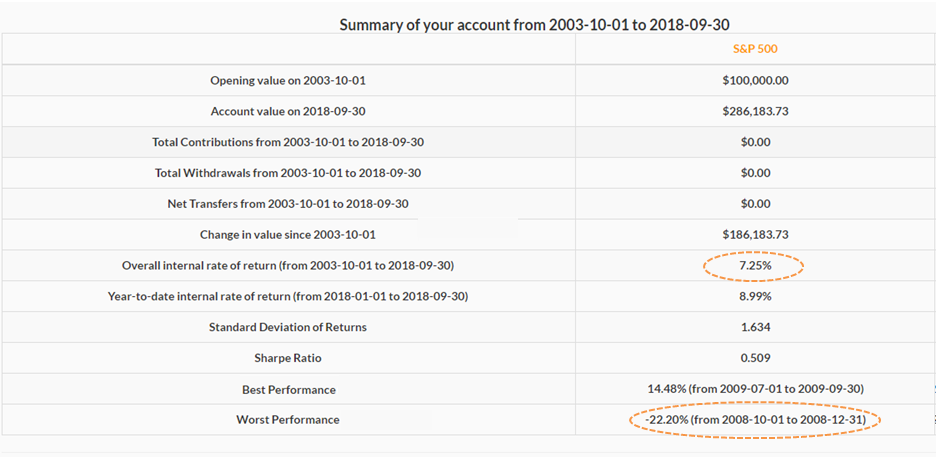

The stock market as a whole has had an average return of 7%. That is not saying that every year, the stock market grows in value of at least 7%. It is an average over the last 15 years, including the tremendous loss it took during the 2008 financial crisis. This is shown by the Worst Performance row of the S&P 500 summary below. The overall internal rate of return (IRR) of the S&P 500 is 7.25%, and the Year-to-date IRR is 8.99% (as of Sept 30, 2018).

CRM2Plus: Analysis of S&P 500 if you invested $100,000 on 2003-10-01

CRM2Plus: Analysis of S&P 500 if you invested $100,000 on 2003-10-01

You can see from the graph snapshot above that over the last 15 years, the market has generally been on an upward trend. So how are we so sure that the markets go up even after a downturn?

When we talk about the growth, we are talking about the market as a whole, and not individual stocks. There are many factors that contribute to an increased value over time.

Technology

As the world develops and technology emerges, the new technological innovations and processes help grow the market. Companies use technology to increase their value. Technology promotes innovation, the human drive to improve, and the R&D in a company. Productivity increases due to technological advances. Companies continue to grow as technology advances and in return, helps to increase their value and grow the market.

Government

The government will always be there to help and stimulate economic activity. If there is a recession or an economic downturn, the government will take action to make sure the economy is still flowing. This is why keeping cash can be riskier than to invest in equities. The government takes great measures to compensate investors. They want to ensure riskier investments perform better than cash.

Paid to take risks

You must take on some type of risk to be able to generate a decent return. Although risk does not guarantee that you will get a return on investment, it is something that you have to take on to even have potential on making returns.

Investing in the stock market is risky. Because of this, companies make it worthwhile and offer a risk premium. Risky assets generally perform better over the long-term. In general, when you invest your money in a company that will probably be profitable, then you will generate a return on your investment.

Inflation

Items that cost $100 ten years ago do not cost $100 now. Inflation rate generally increases by 2-3% per year. As inflation increases, the numeral value of investments does as well. If you keep your $100 in cash 10 years ago, you now have a dramatically lower purchasing power due to inflation. This is a reason why it is important to invest your money. There are studies that show that value stocks perform better in high inflation periods and growth stocks perform better during low inflation. In conclusion, it is imperative to use the money you have to invest instead of lowering your purchasing power by keeping hold of cash.

No one can prevent losses. To help reduce the risk and the negative returns, making sure to diversify your holdings enough will help.