If you are an investor, you know the challenges of making a decent return on your investment portfolio because of the many different risks involved. This includes the constant rising inflation and when the US dollar declines. This leads to your portfolio diminishing in value. You may be wondering if there are investment opportunities you can add to your portfolio to make sure to protect your portfolio to cover all situations in the market.

In this blog, we want to focus on why the precious metal, gold still has its advantages in the modern world and the different ways to invest in the gold market.

History

Gold has a long history, and at a point in time, Gold was a standard currency. It was a transferable form of money that made trades easy. Gold symbolized wealth throughout various continents. In the modern age, gold is non-existent in the monetary system as paper money (promissory notes from the Federal Reserve) was created as a form of currency.

Why Buy Gold

There are several advantages to buying gold.

Preservation of Wealth

Although gold does not back up the local currency and represent money anymore, it is still important to the global economy. Gold preserves wealth and continues to be a safe metal that holds its value through inflation. For example, an ounce of gold from the 1970s is still an ounce of gold today, while in contrast, $50 of paper money held over the same period is worth less today than it did in the 1970s since it is still the same $50. Your wealth would have decreased significantly if you kept the paper money rather than investing in gold. If the same $50 from the 1970s grew at an annual rate equivalent to the US rate of inflation, it would have increased to a value of ~$330 by 2019. Similarly, $50 would have bought approximately 1/5 ounce of gold in the 1970s and would be worth almost $300 in 2019 for the same 1/5 ounce. Gold is an asset class that also acts as a safety net during times of political and economic uncertainty as evident by historical price rallies during recessions and major international conflicts. Considering the above characteristics of gold, it is a good protector of wealth.

Hedging

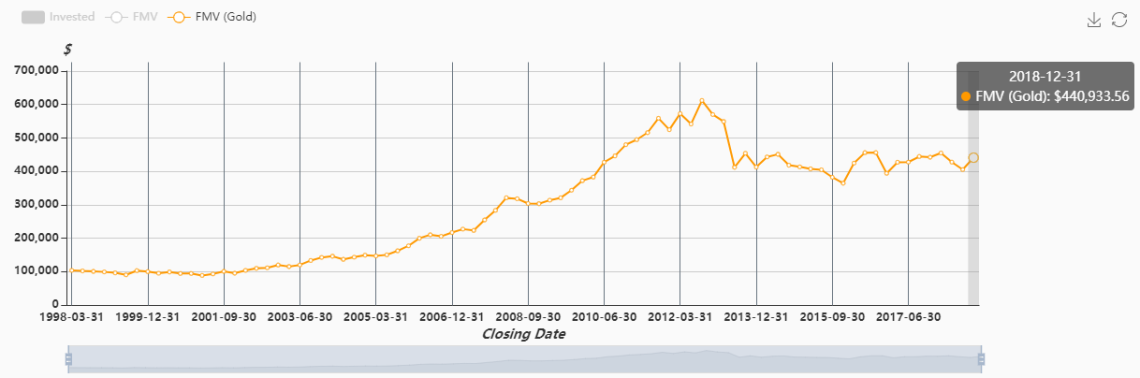

Gold also serves as a hedge against the declining dollar and increasing inflation. Gold has generally maintained its value, as shown in this graph generated on CRM2Plus.

graph generated on CRM2Plus

graph generated on CRM2Plus

Gold typically appreciates with rising inflation. Gold also has a strong negative correlation with the dollar. In other words, when the US dollar declines, the price of gold typically rises.

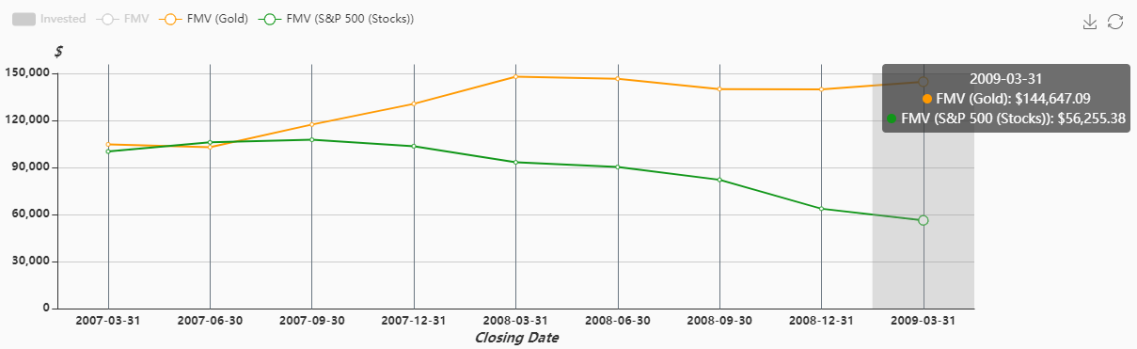

graph generated on CRM2Plus

graph generated on CRM2Plus

You can use CRM2Plus to scroll to a specific time frame for a closer look. From this graph, we can see that Gold has stayed relatively stable during the financial crisis of 2008. The value of $100,000 on March 31, 2009, would have lost almost half of its value if invested the stock market ($56,255), where Gold has appreciated to $144,647. This is because each transaction for gold is denominated in the US dollar and a weakened dollar makes gold relatively cheaper for investors who hold other currencies.

Diversification

Buying gold can be a strong addition to your portfolio and can further diversify your investments. Gold generally has a negative correlation to other asset classes such as stocks, bonds, and even real estate since it is commonly perceived as a safe haven in the event of a severe market downturn. It is a good investment if you want to diversify your portfolio. Read our reasons on why diversification is important.

How to Buy Gold

There are many different investment options if you want to own gold. A few popular ones include:

-Gold Stocks/Companies

-Gold ETFs

-Gold Mutual Funds

-Gold Futures

-Physical Gold (Coins, Jewelry)

The investment option you choose depends on your investment goals. If you don’t want to deal with holding physical gold, buying gold ETFs, mutual funds, or buying shares in a gold mining company may be a good option for you. If you want to use gold as an even further safeguard against inflation and the declining dollar, you may want to directly invest in the ownership of the commodity with gold coins, jewelry, and gold bullion.

As stated, diversification in a portfolio is important so only assigning a small allocation to gold can help to reduce risks. The positive outlook for gold makes it a great investment to add onto your portfolio for the various advantages above.